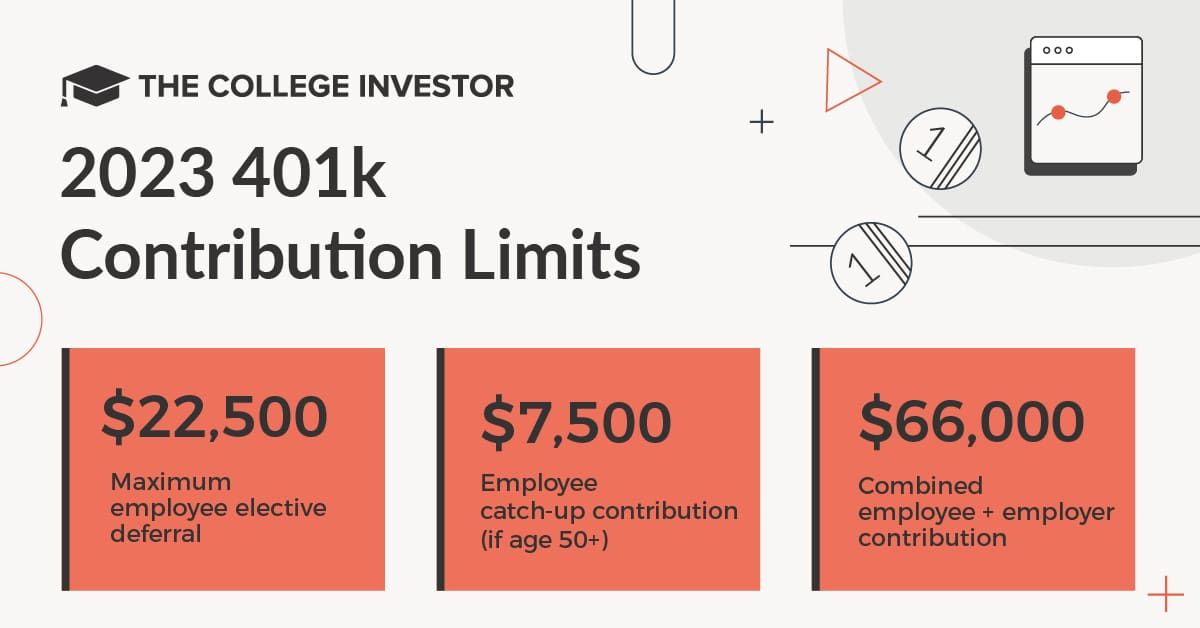

What Is The 401k Limit For 2025 For Over 50. Retirement savers are eligible to put $500 more in a 401. The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

The 2025 401 (k) contribution limit is $23,000 for people under 50, up from $22,500 in. Of note, the 2025 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $22,500 to $23,000.

401k Contribution Limits 2025 Catch Up Over 50 Dacy Rosana, If you are 50 years old or older, you can also contribute up to $7,500 in. Fact checked by jiwon ma.

401k 2025 Limit Over 50 Aggie Sonnie, The total amount of employee and employee contributions to any. The contribution limit for a designated roth 401 (k).

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, Of note, the 2025 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $22,500 to $23,000. If you participate in a 401 (k) retirement savings plan at work, your personal contribution limit in 2025 is $23,000.

The Maximum 401(k) Contribution Limit For 2025, The contribution limit for a designated roth 401 (k). If you are 50 years old or older, you can also contribute up to $7,500 in.

401K Limits 2025 Stefa Emmalynn, For 2025, the solo 401k contribution limits have increased to $69,000, with an additional. Going over the 401 (k).

2025 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, HSA, Employees can contribute up to $23,000 to their 401(k) plan for 2025 vs. The big list of 401k faqs for 2025 workest, in 2025, the contribution limit for a roth 401 (k) is $23,000, plus an additional contribution of $7,500 if you are age 50.

The Best Order of Operations For Saving For Retirement, 2025 401 (k) contribution limits. For 2025, the solo 401k contribution limits have increased to $69,000, with an additional.

2025 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, In 2025, employers and employees together can contribute up to $69,000, up from a limit of $66,000 in 2025. The 2025 401 (k) contribution limit is $23,000 for people under 50, up from $22,500 in 2025.

What Is The 401k Limit For 2025 Over 50 Lexi Shayne, The contribution limit for a designated roth 401 (k). The 401 (k) contribution limit for 2025 is $23,000 for.

2025 Ira Contribution Limits Over 50 EE2022, For 2025, the solo 401k contribution limits have increased to $69,000, with an additional. What happens if you go over the limit?

The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

The irs just announced the 2025 401 (k) and ira contribution limits, those limits change from year to year, but in 2025, the base limit is $22,320, up from $21,240 in 2025.